Among the developers, the goal was to create a program that could quickly, efficiently and reliably ensure the process of accepting applications and ensure their transfer to other services, with further processing of the latter. That is, to ensure a full cycle of receiving, validating and automating work with applications and systems to minimize risks, reduce the volume of "manual work" and increase overall work productivity.

In the end, we managed to develop the software that effectively performs functions such as:

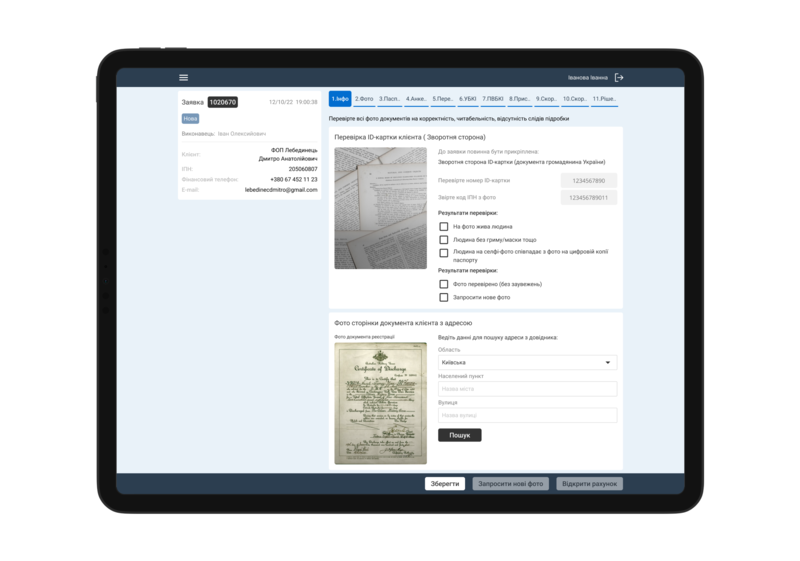

- Verification of the client's documents (form, TIN, passport or identification card, as well as founding documents for a company - LLC);

- Verification of the client's profile data;

- Entering the client's data in accordance with the documents and the questionnaire for further registration;

- Notification of the client about the need to change and supplement data or about the rejection of the application.

- Data transfer for installment software;

- Updating the counterparty's data in the bank's system;

- Opening of contracts and accounts;

- Increasing the client's credit limit;

- Creating and issuing a client card and other.

Creation process involved:

Java 11+, Hibernate, Spring frameworks, RabbitMQ, Kafka, GraphQL/REST API, PostgreSQL, MongoDB, Clickhouse etc.

We implemented the version "for our own" in about six months. In nine months, they came out with a beta for customers. And about a year after the start, a full-fledged project was launched.

The flexible service allows you to automate work with any applications, which reduces the time of data processing and transfer to other systems in minutes, which, in turn, speeds up the process of their implementation, reduces the amount of manual work, errors, etc. in the long run, leading to an increase in overall productivity and quality of work in general.

Who would benefit from the product:

- banks;

- credit companies;

- microfinance institutions;

- other institutions that conduct financial activities related to loans and banking.