Enables remote registration and provides customers with quick access to a full range of financial services.

Among which, as classic banking - payments and deposits, loans\installments, currency exchange and utility payments,

as well as additional ones - QR invoicing, insurance, payment of fines, etc.

For entrepreneurs, an accountant's office, payment of taxes, and fees are also available in the application.

%20(1).png)

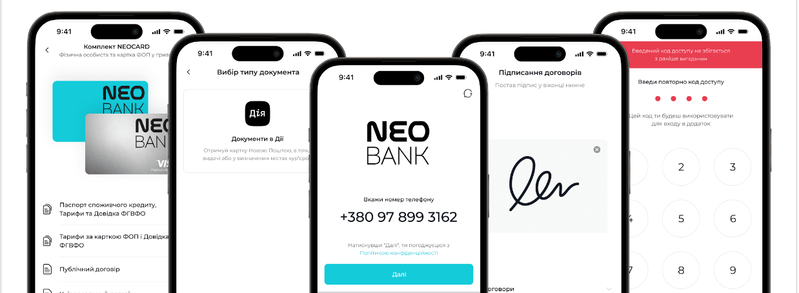

Among the developers, the goal was to create convenient and fast Internet banking for customers with the ability to get a card without visiting a branch.

Create all the competencies so that the product can meet the needs of users as much as possible, and a visit to the bank would be an extreme exception in a force majeure situation.

In the end, we managed to develop a set of applications for Internet banking: a client application and a web version, a payment service, a notification service, integration modules with various external partners and many other microservices.

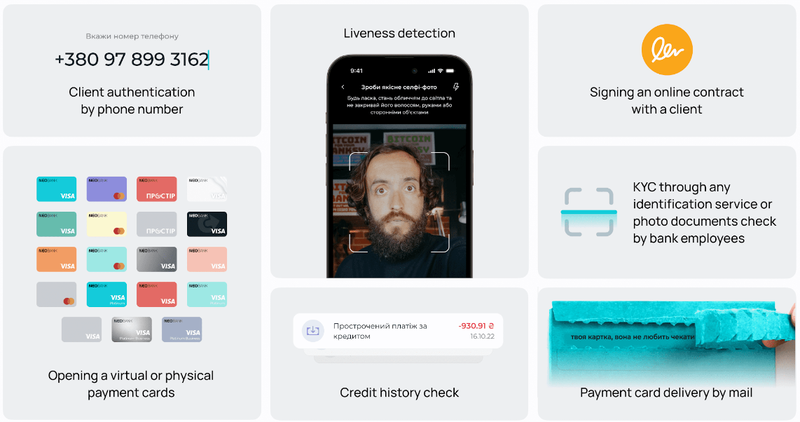

What in the pile allowed to quickly and reliably identify the client in accordance with the law, excluding the possibility of getting into fraudsters and potentially dangerous objects and entering into financial relations quickly, completely remote with reliable services consumers. All this became possible due to the fact that NEOBANK carries out KYC of clients with verification in a large number of databases and registries (fraudsters, PEPs, etc.) and uses liveness detection with the creation of electronic digital signatures.

In the creation process were involved:

Java 11+, Hibernate, Spring frameworks, RabbitMQ, Kafka, GraphQL/REST API, PostgreSQL, MongoDB, Clickhouse etc.

Results that have been achieved:

- fully remote with fast onboarding (3-5 minutes)

- registration of a new client with photo documents

- client verification using liveness detection

- KYC with checks through the databases of lost passports, PEP, terrorists, and UBKI

- opening of physical and digital cards in various currencies with the possibility of receiving them at Nova Poshta branches and post offices, card issuing points, or delivery by courier

- P2P transfers to Ukrainian and foreign banks

- IBAN, SWIFT, SEPA, Visa Alias transfers

- utility payments and mobile top-up (including numbers of foreign operators)

- deposit constructor

- credit products: credit limit, installment plan, instant card credit, restructuring

- currency exchange, currency orders, certificates, fines, and insurance

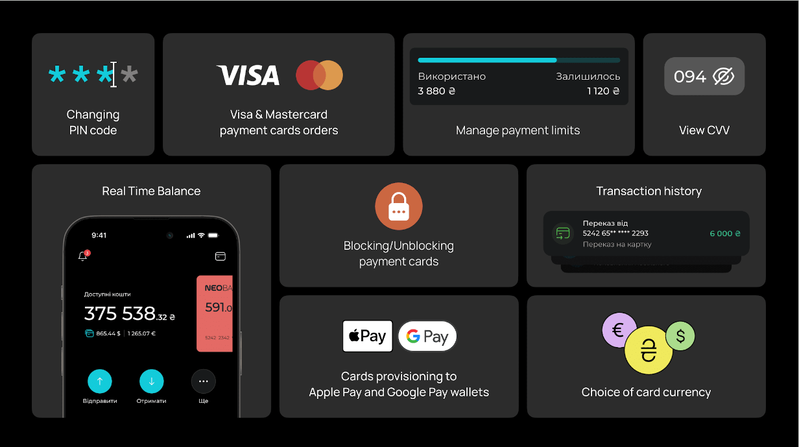

- change of PIN code and financial number online

- management of transaction limits and revision of NBU limits

- blocking/unblocking of cards

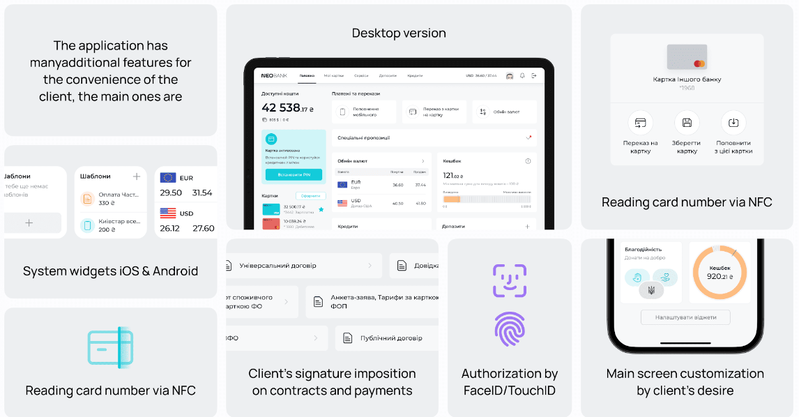

- iOS and Android system widgets

- authorization by FaceID/TouchID and reading the card number via NFC

- and of course, the possibility of remote closing of accounts

And more:

- a developed system of PUSH/RICH communications with customers (including regulations) with the possibility of sending interactive content to customers (graphics, videos, skin casts of functional descriptions of new products, etc.)

- system of "pressing" customer registration, integrated with the SRM system

- friendly notification about the client's operations

- integration of the Support Service with the most common messengers

- web version of banking

- convenient widgets of the main screen with the possibility of their customization and cost analysis

- referral system for attracting new customers

- cashback accrual service

- and, of course, interactions with our clients: an Easter space game, where we, together with clients and the customer, collected "eggs" that turned into funds for the Armed Forces and a quest with points on the occasion of NEOBANK's birthday, where funds and prizes were already received by our clients.

Thanks to the developed software, service systems, and flexible integration, which can be fully adapted to the requirements of the customer and business, it becomes possible to expand new financial horizons for banks that do not have a remote registration service. At the same time, the verification services themselves can be used by non-banking companies that need to verify their customers, which will significantly expand the user base and increase their "quality".

NEOBANK is an important element of Concord Fintech Solutions, which won gold in the Best fintech ecosystem nomination at the Ukrainian Fintech Awards in 2022. The NEOBANK project itself during its existence has already entered the TOP-3 in the "Best Digital Bank" nomination and the TOP-5 in the "Mobile Banking" nomination in the "25 leading banks of Ukraine during the war" rating. It took 8th place in the nomination "TOP most popular mobile applications of commercial banks" in the rating "25 leading banks of Ukraine during the war" and received thanks for help and cooperation in meeting needs. It is the main component of the bank, which ensures its direct functioning.

Whom the product will help:

- Banks without their own software

- Nonbanking companies to verify customers

- Individual clients and entrepreneurs carry out their daily financial activities

- Entrepreneurs who carry out business activities